When you need to borrow money—for home or other personal expenses—there are many lending options for you to consider. If you own your own home, tapping into its equity to get a lower interest rate may be appealing, especially as interest rates rise. While mortgages may seem pretty straightforward, home equity loans and lines of credit can create a lot of confusion for customers, from understanding how to calculate ‘equity’ to knowing which type of lending product is best for individual situations.

What is a Home Equity Line of Credit?

A home equity line of credit is a revolving credit line, where you can borrow up to a certain amount of money, as needed, paying it back in installments. Like a credit card, when you pay back the principal amount you’ve borrowed (not the interest), your borrowing limit is replenished. Unlike a credit card, which is unsecured debt, HELOCs are secured by the equity in your home.

HELOCs usually allow you to borrow up to 80-90% of the equity in your home—that is, the value of your home adjusted for what you owe on it—but you don’t have to use all the funds you qualify for. In fact, many people utilize HELOCs as an emergency fund, rarely if ever touching them.

HELOCs vs. Home Equity Loans

HELOCs are similar to home equity loans in that they are secured by the equity in your home, but beyond the use of your home equity as collateral, these lending products are quite different. With a HELOC, you can borrow funds as needed, up to your limit, making payments and paying interest only on the amount you borrow.

With a home equity loan, sometimes called a “second mortgage,” you receive a lump sum of money, paying the full balance back in installments over a set term. Let’s take a closer look at how these two products stack up to see which one might make the most sense for your borrowing needs.

When would you choose a HELOC over a home equity loan?

As we mentioned above, the biggest differences between a HELOC and a home equity loan are how you receive your funds and how you pay them back. When choosing which one makes the most sense for you, it’s important to consider how these differences will come into play.

Here are a few instances when HELOCs may be the best fit:

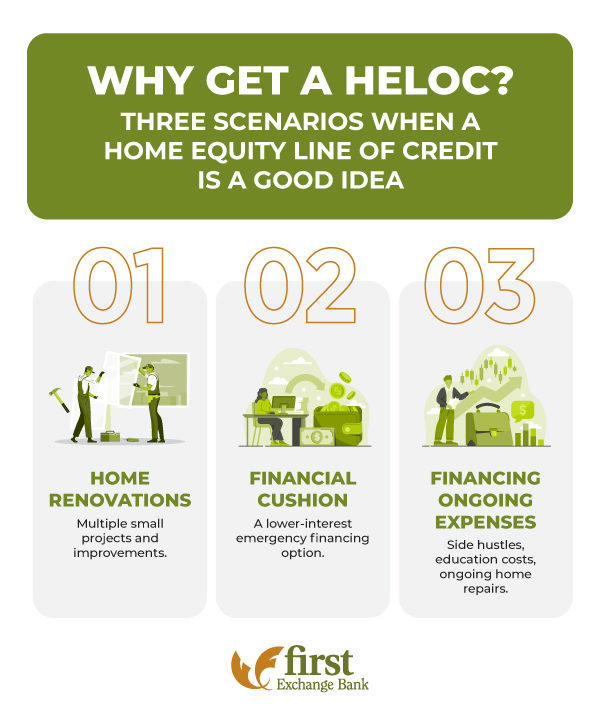

Home renovations: Multiple small projects and improvements.

When you are completing one major renovation with a fixed cost—for instance a kitchen remodel or addition—a home equity loan can make a lot of sense. You will borrow the amount you’ll need for the project, and pay it back in fixed, predictable monthly installments.

However if you don’t have a fixed price for your project, are completing more than one improvement, or need to make a series of payments over an extended period of time, a HELOC might work better. With a HELOC you can use an associated card or check book to make payments, as needed, during your HELOC’s draw phase, paying interest only on your current balance—the amount you’ve borrowed (and haven’t yet paid back).

Financial cushion: A lower-interest emergency financing option.

It’s important to set aside money for your unexpected expenses. But having a contingency plan to cover large, popup costs can be a smarter financial choice than relying on unsecured, high-interest financing, like credit cards. HELOCs can be used to cover emergency repairs on your home, medical expenses, and emergency expenses.

Why does a HELOC make for a good emergency fund? There is no requirement to utilize the funds available to you when you open a HELOC, and it’s common to open one and keep it open, without having a set expense in mind. Additionally, because HELOCs are secured by your home, interest rates tend to be much lower than those of credit cards, generally resulting in significant interest savings.

Financing ongoing expenses: Side hustles, education costs, ongoing home repairs.

Maybe you’re a house flipper who needs to manage the ebb and flow of cash between renovation projects and home sales. Maybe you have a college student in your family, and you want to help with tuition payments, without utilizing a higher-interest parental student loan. Or maybe you have an older “fixer upper” house that will need ongoing repairs and upgrades over the years. When you have major ongoing expenses, home equity lines of credit can help you manage your personal cash flow, much in the same way a business might use a line of credit to handle the ups and downs in income and expenses.

Additionally, HELOCs don’t have to be used for one set purpose. If in the next few years you expect to have a lot of different major costs come up, you may want to consider a HELOC as a flexible, simplified financing option over multiple, smaller loans. For instance, if you want to pay off credit card debt, finance a car purchase, and also upgrade your home’s HVAC in the next year, a HELOC could cover all these needs, with the benefit of a single closing and single payment.

How Does a Home Equity Line of Credit Work?

As we discussed above, a HELOC is an open, revolving line of credit, and it can essentially function as a series of smaller loans under one lending product. Unlike a home equity loan, your interest rate will be variable, and your payments will change over the course of the loan. But you may be wondering how to get a HELOC and how exactly they work. Here’s the basic process of opening and using a HELOC.

1. Application

Home equity line of credit requirements include sufficient income, good credit, and adequate equity in your home. Similar to a mortgage, you’ll need to apply for your HELOC, providing relevant personal, property, and income information to your bank.

Your lender will examine your credit history, using the information to help determine your interest rate.

Your lender will also be sure that you have sufficient income to pay back all your debts—including the new HELOC. Debt-to-income ratios of 43% or less may be necessary. You will need to provide documentation for income in the form of tax returns, pay stubs, and/or financial statements.

Lastly, you will need to provide details about the property and your current mortgage loan, if you have one. Your bank may order an appraisal to determine your home’s value. You generally need at least 20% equity in your property (the value of your property adjusted for any outstanding loans against it) to qualify for a HELOC.

Don’t have enough equity in your home? Personal lines of credit may be a useful alternative to HELOCs. Check out our post, Home Equity Line of Credit vs. Personal Line of Credit, to learn more about them and how the two similar products compare.

2. Closing

From the time you apply to closing, the process often only takes a few weeks. Closings are simpler than typical mortgage closings because only one party (you) is usually involved, and no property is changing hands.

Closing dates can be more flexible than with a mortgage, and with a HELOC from First Exchange Bank, we pay all the closing costs!

3. Using Your HELOC

Most banks supply a checkbook for your HELOC so you can make easy, direct payments. Many financial institutions can also give you a debit card for the same purpose. Lastly, you can also use online banking or an in-person branch transaction to transfer funds from your HELOC to your checking account.

Remember, you do not need to use all your HELOC funds at once—and you have the entire duration of your draw period (more on this below) to use your line of credit, as needs arise. Limiting the use of your HELOC to what you really need it for (and not for everyday living expenses) can help you save on interest.

4. Paying It Back

HELOCs have two distinct phases: the draw phase and the repayment phase. During the draw phase (120 Months with a First Exchange Bank HELOC), you can use your HELOC as needed, making monthly payments on the money you’ve used. You may also pay down your principal during the draw phase, which can help you save money on interest and will replenish your funds available under your HELOC.

After your draw phase, your HELOC will enter the final phase, repayment. The repayment period is 180 months with First Exchange Bank. Here, you can’t borrow from your HELOC any longer, and you’ll pay back both interest and principal in monthly installments divided up over the duration of this phase. Your payments could possibly be larger than those during your draw phase and your interest rate could change.

Finding the Best Home Equity Line of Credit in North Central WV

When you’re ready to explore your home loan options, you can count on First Exchange Bank. With dedicated, customer-focused team members and fast, local approval decisions, we offer a convenient, competitive alternative to large, national banks.

Speak to a local lender in Fairmont, Fairview, Morgantown, Hundred, Mannington, or White Hall, West Virginia to learn more about our many different financing choices, and find the right one for your lending needs!