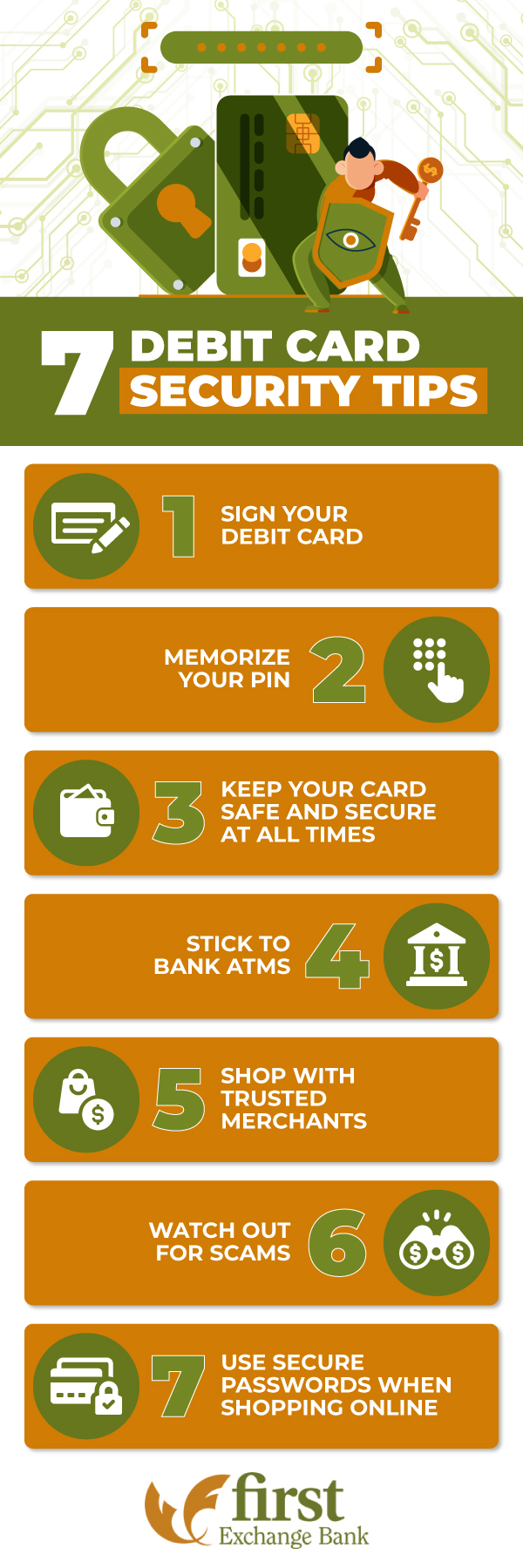

As we shop and conduct other parts of our lives online more and more, it’s important to safeguard our personal and financial information. In this article, we’ll share seven debit card tips to help you protect against fraud and identity theft.

Sign Your Debit Card

While it may seem antiquated in the age of chip cards and contactless payment, signing your debit card is still a requirement. In fact, it means you agree to the terms and conditions set by your card issuer. So, sign the back of your debt card every time you receive a new one; otherwise, it’s technically invalid.

If you’re worried about fraud, the good news is that signatures are now electronically verified instead of comparing the signature on the receipt with the one on the back of your card. In many instances, signatures are not even required for purchases anymore. So, you don’t need to worry about your signature exposing you to the risk of fraud. And by signing your card, you’ll stay on the right side of rules and requirements, especially for those individual merchants who still require a signature.

Memorize Your Personal Identification Number (PIN)

This four-digit number should be safeguarded as carefully as the other important numbers in your life (social security, bank account, etc.). Don’t share your debit card PIN with anyone and keep it memorized so you don’t need to write it down anywhere. If you do want to write it down, keep it in a safe, secure place–not on the card itself or elsewhere in your wallet. Consider writing down a hint instead to help jog your memory.

When creating a debit card PIN, avoid using numbers that are easy to guess like birthdays or addresses. At ATMs, make sure no one is standing close enough to you to see the numbers you enter. Use your body to block the view of the keypad.

If you think your debit card PIN has been compromised, contact us immediately at any First Exchange Bank location during business hours or 800-236-2442 after hours.

Keep Your Debit Card Safe and Secure

While we hear a lot about cybersecurity, the physical security of your debit card is also important. That’s why you should:

- Leave it at home unless you intend to use it.

- Don’t carry multiple debit cards with you at the same time.

- When running errands, never leave your debit card visible in your vehicle.

- If your debit card is your primary payment method for everyday purchases, don’t keep too high of a balance in case your card is lost or stolen

- Keep extra money in savings instead of checking.

- Consider linking your debit card to the digital wallet app on your phone. Then you can pay with your debit card at checkout without actually needing to use the physical card.

If you want to keep a higher balance in your checking account, consider opening a separate account just for debit card use where you only hold as much as you need to spend on bills and everyday purchases.

In addition to following these debit card safety tips, review your monthly checking account statements:

- Keep receipts of all your transactions so you can reconcile them with your statement.

- If you see any questionable transactions, contact your bank immediately.

- Report any suspicious or fraudulent charges immediately.

Use Bank ATMs Only

Limiting your ATM usage to bank-issued ATMs will help you avoid card skimmers. Skimming is when scanners or other devices are added illegally to ATMs and POS terminals such as at gas pumps. Scammers use skimming to steal card information so they can make unauthorized purchases using your debit card.

Follow these tips to avoid skimming:

- Examine the card reader for signs of tampering.

- Look for ripped security tape.

- Pay for gas inside with the cashier instead of at the pump.

- If your card gets “stuck” inside the ATM, call to cancel it immediately–it could be a scam instead of a genuine mistake.

Shop Online With Merchants You Trust

When shopping online, stick to national retailers and other merchants you know and trust. Go directly to a merchant’s website to start shopping. If you do a web search for a certain item, be wary of sponsored search results, especially if the price seems too good to be true. This could be a scam to draw you to a fake website and steal your personal and payment information.

Before shopping with a new e-commerce site, look for a padlock symbol next to the web address–this means the site is secure. It’s also a good idea to check for a “Contact Us” page with a valid address and phone number.

As an alternative to using your debit card for online shopping, you can use a designated credit card instead. Earn reward points for merchandise and travel while using your Visa® Rewards Platinum credit card from First Exchange Bank.

Whether you’re using a credit or debit card, only make online purchases and log into online banking and financial accounts when connected to a private, password-protected WiFi network. Avoid transmitting sensitive information over a public WiFi network, such as at the library, coffee shop, or hotel.

Watch out for Targeted Scams

Scammers will also try to trick you into sharing your debit card information. Protect yourself from phishing scams:

- Don’t give your debit card information to anyone who calls, texts, or emails you claiming to be from your bank or another organization you’re familiar with.

- Before clicking on links someone sent you, hover your cursor over the link for a few seconds to see what the true URL is.

- Instead of responding to a message that something is wrong with your account, call the retailer or financial institution directly to check if there is really a problem.

Use Secure Passwords

Protect your online and mobile banking apps, as well as any other accounts in which your financial information is stored, by practicing good password habits. This includes Amazon, Walmart, Target, and other retailers you shop with.

To create a strong password, use a combination of letters, numbers, and symbols. Avoid common letter or number sequences, as well as easily available personal information such as your hometown, spouse’s name, etc. Try a passphrase instead of a password. Use a unique password for every account, so that if one is compromised, the others are still protected. And change your passwords regularly–every six months or a year.

Finally, you may want to avoid storing your payment information altogether. Although it can be convenient, your debit card will be more secure if you have to re-enter your payment information with each purchase. As a bonus, this may also keep you from making impulse purchases you will later regret.

Report Lost or Stolen Cards or Fraud Incidents Immediately

If your debit card is lost or stolen, call to report it immediately to any First Exchange Bank location during business hours or 800-236-2442 after hours.

First Exchange Bank is committed to your security!

As your community bank in North Central West Virginia, we are here to help you with debit card safety and security. Learn more about our debit and credit cards and check out our recent blog articles on cybersecurity tips and identity theft prevention. Have questions about your bank account, debit card, or credit card? Contact us or visit one of our seven offices located in Mannington, Fairmont, Morgantown, Hundred, Fairview, and White Hall.