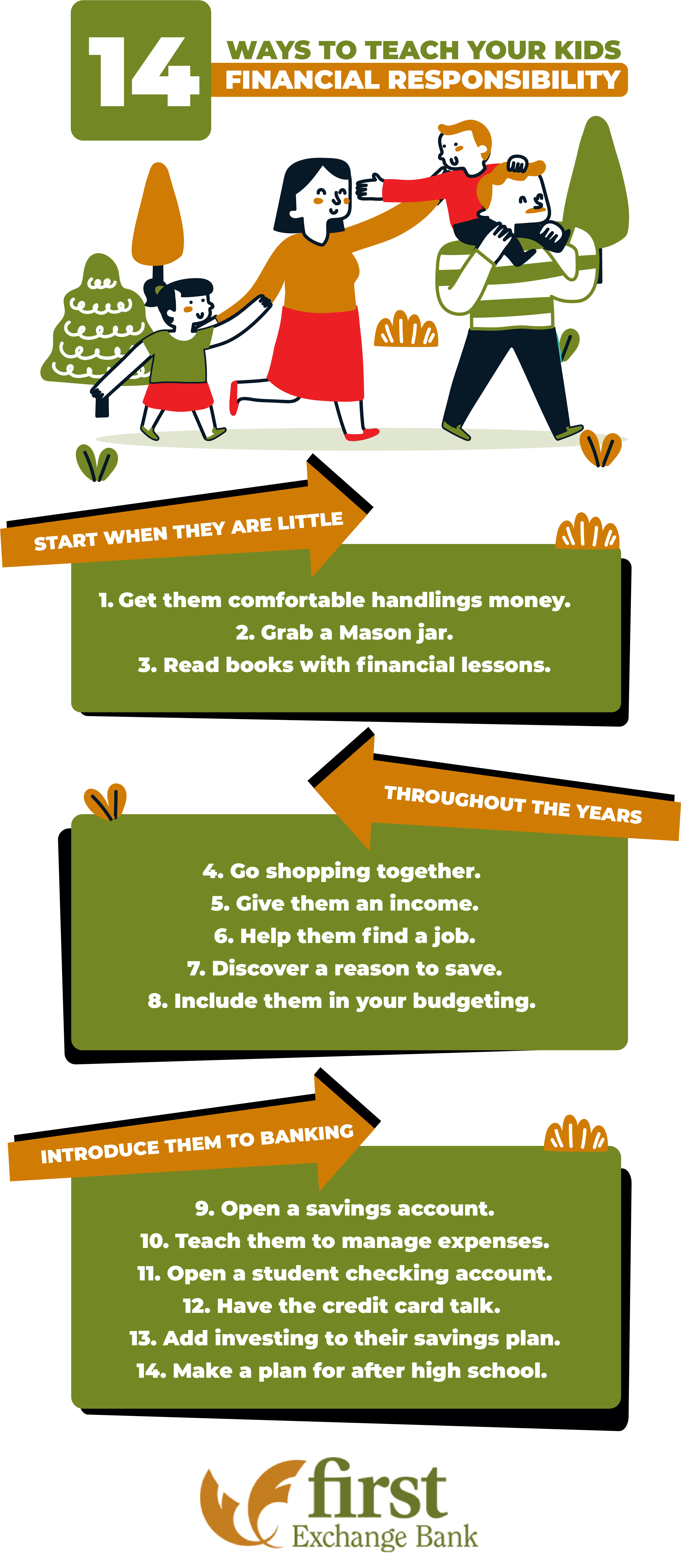

How often do you talk to your kids about money? April is financial literacy month, a month dedicated to promoting financial education and increasing smart money habits. At First Exchange Bank we believe that the earlier you start teaching your kids how to manage money, the more financially secure they will become as adults. You don’t need to be a financial guru to make a difference in your child’s future. Here are some simple ways to help your children become more confident and successful when dealing with money.

Start when they are little

Starting around the age of 2, children begin modeling adult behavior and developing habits of their own. Between the ages of 7 and 9, some of these habits become integrated into lifelong personality traits that shape how your children will handle money when they are older. Habits such as the propensity to delay gratification or succumb to impulses can affect a child’s spending habits as an adult. Start introducing age-appropriate money education and games in toddlerhood to promote financial literacy at a young age.

Get comfortable handling money

Once your kids can be trusted not to put coins in their mouth, let them roll, stack, and examine the different denominations of coin money. Make a game out of exchanging five pennies for a nickel, and so on. Encourage them to open a pretend store and sell you items from around the house for a few pennies or dimes. Once your kids are familiar with the different denominations of coins you can show them how many coins can be exchanged for paper bills. Understanding the value of a dollar is a memorable lesson when they have to count out 100 pennies to exchange.

Grab a Mason jar

While ceramic piggy banks are the traditional symbol of childhood savings, new research suggests that clear containers are a better savings motivator for many kids. Grab a clear jar from around the house, put a few coins or a dollar inside, and give it to your child as their savings jar. Encourage your child to add to their savings whenever they receive a financial gift. Even forgotten coins found along the sidewalk can be added excitedly to their new bank. Through the walls of their clear savings jar, children can see the money they have put aside and watch it grow every time they contribute.

Discover books with financial lessons

No matter the age of your children, authors have published lots of stories and guides that focus on building smart money habits. Parents.com offers a great list of financial themed books for kids of all ages. Whether you read these books as a bedtime story or challenge your kids with money-related math problems, books are a terrific way to integrate financial education into your child’s day.

Throughout the years

Go shopping together

In today’s society, opportunities to shop with your kids are dwindling. Between online retail shopping, curbside grocery pickup, and restaurant delivery services, Americans are spending less time in brick and mortar establishments. Purposefully choose to include your children in your shopping and show them how much everyday items cost and how you pay the bill. If you are choosing a sale item over a full price product, point out the difference in price and demonstrate how you make choices that save money. You can teach good financial habits by explaining different ways to save money such as:

- buying in bulk

- shopping during a sale

- finding and using coupons

- subscription discounts

Give them an income

There are two different mindsets when it comes to giving kids an allowance. Some parents provide a weekly income to their children with no strings attached. If, in exchange for this allowance, parents refrain from purchasing treats and toys for their children, kids can learn to budget their allowance and save for the things they want. This can teach kids how to control impulse spending and manage a small income.

Other parents require their children to perform household chores in order to receive an allowance. By requiring kids to do some work in order to get paid, parents are sending the message that money has to be earned. This can lead to a deeper appreciation for money and more responsible spending. If you are considering a chore based allowance model, here is a list of age appropriate chores from The Spruce to help you get started.

Help them find a job

As your children get older, encourage them to get a part-time job. Chances are that a weekly allowance will not cover all of the expenses that come with being a teenager. Start encouraging kids to take up dog walking or babysitting when they are in middle school. Once they are old enough, assist them with finding time and transportation for a part-time job that will help pay for dates and other extracurricular activities.

Discover a reason to save

If you have a child that does not seem motivated to save their money, consider whether they have anything particular to save towards. Some kids simply have not thought of a big purchase worth saving for and, unfortunately, saving for college is probably not a huge motivator.

No one knows your children like you do. Help them brainstorm reasons to save their allowance or earnings. If your “big idea” seems financially out of reach to your child, consider contributing a portion of the purchase price. Your contribution does not ruin the financial lesson. They still must work to set a financial goal and save money until it is reached.

It is important to teach your kids that they can save towards experiences as well. Present this as an opportunity for your kids to do something that you, as a parent, may not have spent money on willingly in the past. Some experience items that may motivate your children to save include:

- Tickets to sporting events

- Surf, ski, or skateboard lessons

- Concert or movie tickets

- Theme park passes

Include them in your budgeting

Involve your children in your monthly household budgeting. Don’t have a budget? Get started today with this easy guide, How to Create a Budget. Don’t be reluctant to share your income and fixed expenses with your children. Only by seeing your real world numbers will your kids truly understand the costs associated with running a household.

Once you subtract your fixed expenses, debt repayment, and savings each month, your children may be surprised by the amount of income left over for groceries, restaurants, vacations, and fun. Preparing a household budget together should help them understand the concept of needs v. wants and help grow a sense of financial responsibility.

When your kids have their own income and expenses, sit down and help them create a monthly budget of their own. Allowing them to time practice managing their monthly finances will set them on the road to success in adulthood.

Introduce them to banking

Open a savings account

Once it seems like your child has developed a desire to save, take them to your local community bank and open a kids savings account. Involving them in the process of opening the account as well as making deposits and withdrawals will help them gain financial literacy and confidence in a bank setting.

If your child enjoys receiving mail, make sure you sign up for paper account statements so they can have the satisfaction of getting a monthly report on their youth savings account. We advise against forcing your child to contribute to their savings account or forbidding them from withdrawing money. Saving should be a positive experience. Try to gently guide your children and offer advice without taking away their autonomy.

Teach them to manage expenses

Once your kids have a steady income stream from an allowance or employment, they can learn to budget for recurring expenses. Recurring expenses that kids can pay for include:

- Monthly video game subscriptions

- Music and video streaming services

- Monthly payments on a new cell phone

In addition to recurring expenses, teenagers can be tasked with contributing to their car’s gas, insurance, and maintenance bills.

Give your children this level of financial responsibility while they still have you to fall back on. If they mess up, teach them that they can come to you for help. Financial responsibility takes practice so give your children lots of opportunities to develop their skills.

Open a student checking account

Once your children start paying for their own expenses, it is time to teach them how to manage a checking account. You can get a student checking account designed just for teens. Using a debit card and even writing a check are important skills that you can teach your children. Help your kids develop a habit of checking their account balances frequently to avoid overdrafts and fraudulent charges.

Have the credit card talk

One reason some parents shy away from financial discussions with their children is the fear of shining a light on their own financial flaws. The truth is that by the time your kids are in middle school, they know you are not perfect. Don’t avoid talking about credit cards if you have outstanding debt and haven’t always paid your card balance off in full.

Instead, set your kids up for success by teaching them about the high interest rates on credit cards, even showing them examples if you have them to share. Teach them that a minimum payment on time is better than a late payment in full, and that credit cards equate to real money and real debt. By sharing tips for building credit and the advantages of maintaining a good credit score, you are saving your children lots of money on interest payments down the road.

Add investing to their savings plan

The next step for a child that has started saving and budgeting is to increase the amount of interest they earn on their savings. Explain interest rates, and show your child how much their savings could earn if left in a high-yield savings account or certificate of deposit (CD).

Investing can be scary, even for adults. While CDs and savings accounts are FDIC insured against loss, stock investments are at the whim of the market. Plus the stock market can be intimidating if you do not have experience trading. It is ok not to know where to begin when investing in the stock market.

Many successful investors grew up learning about the stock market from their parents. Today, some stock trading platforms have beginner friendly investment simulation programs in which new investors can experiment with stock market trades without committing real money. Webull is one trading company that offers mock stock portfolios to get you started. If you are new to investing, make it a family learning experience or even contest to see who can make the smartest mock investments. Coming together as a family to learn about investing will strengthen your bonds and fuel your relationship with your children for years to come.

Make a plan for after high school

Start brainstorming plans for after graduation. Whether your child is leaning towards a four year college, trade school, or full time employment, having a plan in place will help prevent the accumulation of debt and lost time. If your kids are planning on attending more school, be sure to discuss the impact of student debt on their future earnings. Map out a plan for part-time employment while they are in school to help cover their living expenses. If your children are heading for full time employment, help them create a budget that accounts for new expenses and includes retirement savings.

The right time is now

First Exchange Bank has been helping families achieve financial success for more than 90 years. As your community partner, we are here to provide support whether your family needs to open their first savings account, get advice on budgeting, try a student checking account, or experiment with investment accounts.

Open an account for your child today. Give them the full banking experience by visiting us at one of our North Central West Virginia locations. Our friendly associates are ready to assist in Fairmont, Fairview, Morgantown, Hundred, Mannington, and White Hall. If you have questions about choosing the right banking products for your family, contact us. We love seeing families work together to create bright financial futures.